Medicare FAQ

1. What is Medicare?

Medicare is a federal health insurance program mainly for people aged 65 and older, but also available to some younger individuals with certain disabilities or health conditions.

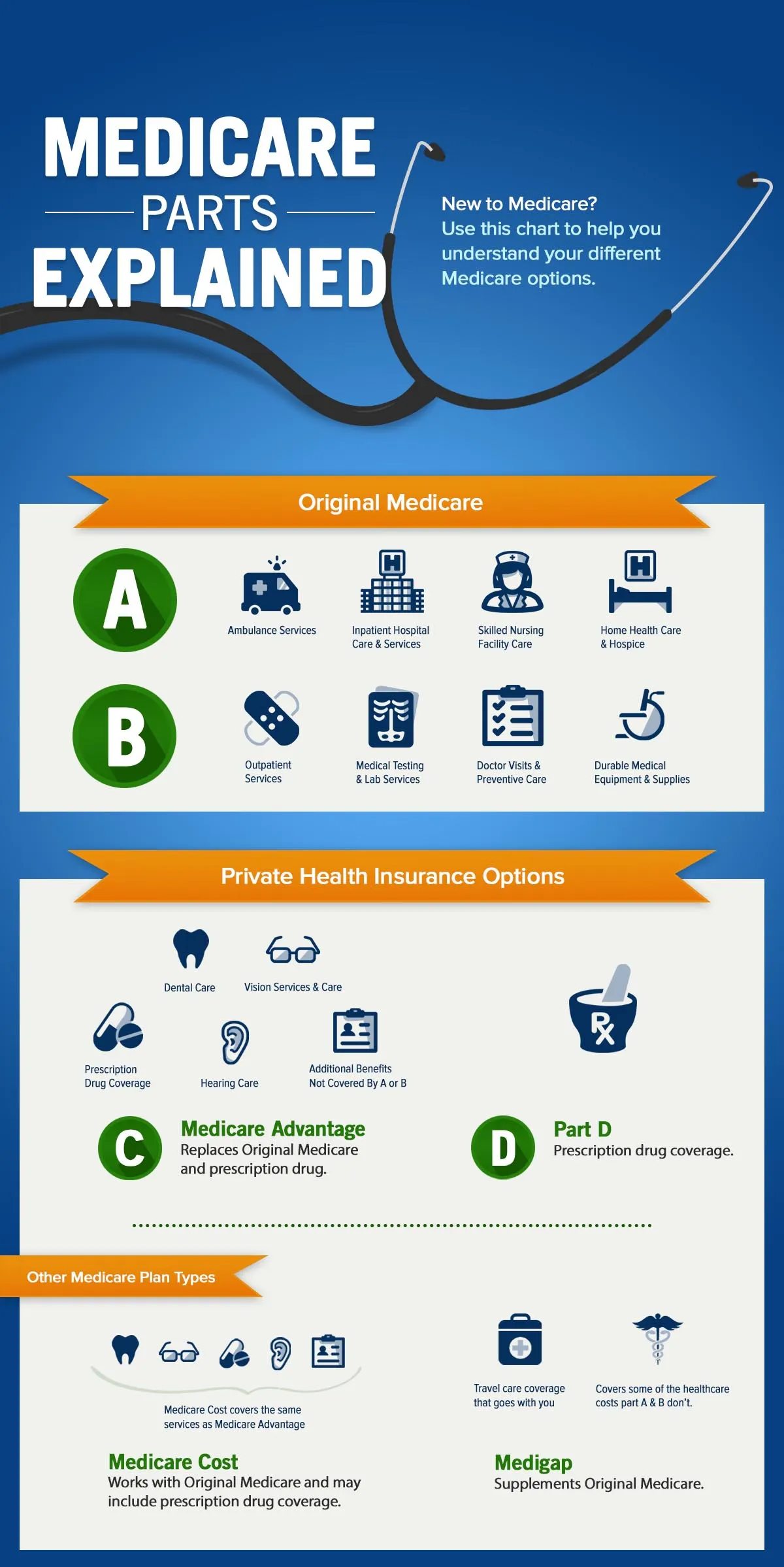

2. What are the different parts of Medicare?

- Part A: Hospital insurance—covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care.

- Part B: Medical insurance—covers doctor visits, outpatient care, medical supplies, and preventive services.

- Part C: (Medicare Advantage)—offered by private companies; combines Parts A & B, often includes drug coverage and extra benefits.

- Part D: Prescription drug coverage—helps cover the cost of medications.

3. When can I enroll in Medicare?

Most people enroll around their 65th birthday. The Initial Enrollment Period is a 7-month window: three months before your birthday month, your birthday month, and three months after.

4. What happens if I miss my enrollment window?

You could face penalties or delays in coverage. Some special situations (like working past 65 with employer coverage) may qualify you for a Special Enrollment Period.

5. Do I need all the parts of Medicare?

Not always. You can choose what works for your situation—some people stick with Original Medicare (Parts A and B), some add Part D, and others opt for Part C (Medicare Advantage).

6. How much does Medicare cost?

- Part A is usually premium-free if you or your spouse worked and paid Medicare taxes long enough.

- Part B has a monthly premium (amount varies annually).

- Part C and Part D costs depend on the plan you choose.

7. Does Medicare cover everything?

No. Original Medicare doesn’t cover most dental, vision, hearing care, or long-term care. You might want supplemental or “Medigap” policies or a Medicare Advantage plan for more comprehensive coverage.

8. Can I get help paying for Medicare?

Yes! There are programs like Medicaid, the Medicare Savings Program, and Extra Help for prescription costs if you meet certain requirements.

9. Can I keep my doctor?

Most doctors accept Medicare, but not all. Always check if your preferred providers are in-network for the coverage you select, especially with Medicare Advantage plans.

10. How can VitalShield help me with Medicare?

Our licensed agents can walk you through your options, compare plans, and help you find the best fit based on your health needs and budget—making the process simple, clear, and stress-free.