Chapter 2: How It Works (or "The Secrets They Won’t Tell You")

How does an IUL pull off this magic trick? Here’s what they don’t teach you in school.

With an IUL, your cash value—the money you’re stashing away—earns interest linked to the stock market. But, get this: when the market crashes, you don’t lose a single penny. Why? Because your money has a “floor.” It’s like insurance for your insurance. When the market’s on a roll, your cash value grows. When it tanks, you just sit there with zero losses. The IUL guarantees that.

Think of it as the difference between sitting on a roller coaster versus a luxury cruise. You’re along for the gains, but none of the downs. Sound good?

Let me tell you a little secret about money—one they don’t teach you in school. It’s how the rich get richer without ever losing sleep over stock market crashes, and it’s all wrapped up in something called an Indexed Universal Life policy, or IUL. But don’t let the fancy name scare you off. Once you see how this works, you’re going to wonder why everyone isn’t doing it.

So, How Does an IUL Pull Off This Magic Trick?

Let’s cut through the fluff. With an IUL, your cash value—the money you’re tucking away—doesn’t just sit there collecting dust like in your savings account. No, it’s busy earning interest that’s tied to the stock market. But here’s the kicker: when the market takes a dive, you don’t lose a single penny. Not one cent.

Why? Because your IUL has something called a “floor.” Think of it as a safety net. It’s like insurance for your insurance. While everyone else is panicking, watching their retirement accounts sink, you’re just sitting there with your money locked up tight, safe from harm.

And when the market goes up? Well, that’s when things get fun. Your cash value grows, riding the wave of the market’s gains. But here’s the genius part: when the market tanks, your IUL doesn’t follow it down. It simply locks in your gains and waits for the next upward swing.

The Roller Coaster vs. The Luxury Cruise

Let’s put this in plain English. Imagine you’re at an amusement park. Most people are stuck riding the roller coaster—up, down, screaming at the dips, holding their breath at the top. That’s the stock market for you: thrilling when it’s good, gut-wrenching when it’s bad.

Now picture yourself on a luxury cruise. Calm seas, steady progress, and you’re sipping on a drink while everyone else is freaking out on the roller coaster. That’s the IUL. You’re along for the market’s gains, but when it gets rough, you don’t feel a thing.

What About the Fine Print?

You might be thinking, “This sounds too good to be true. What’s the catch?” The truth is, there’s no catch, but there are rules. For example, your gains are capped at a certain percentage, usually around 10-12%. So, if the market skyrockets 30% in a year, you’ll only see a portion of that growth. But ask yourself this: would you rather take a steady 10% or risk losing half your savings in a crash?

That’s the power of the “floor and cap” system. It protects you from the market’s chaos while still giving you a healthy share of the upside.

Your Personal Wealth Machine

An IUL isn’t just some boring life insurance policy; it’s a machine—a wealth-building machine. It grows your money tax-deferred, lets you access it tax-free, and still provides your family with a tax-free death benefit. It’s like having a Swiss Army knife for your finances, with tools for every situation.

And here’s the kicker: while your cash value grows safely, you’re also protecting your family. That’s the legacy piece. If something happens to you, your loved ones get a payout that can pay off debts, replace income, or keep the family home intact.

The Question You Should Be Asking

Now, here’s what I want you to think about: If you could grow your money, avoid market losses, and leave a legacy for your family—all without the stress and sleepless nights—why wouldn’t you?

An IUL isn’t for everyone. But if you’re tired of the roller coaster and ready to step onto the luxury cruise, it might just be the smartest financial move you’ll ever make.

So, let’s cut through the confusion and make it simple. This is how the wealthy protect their money and grow it without the risk. And now, you can too.

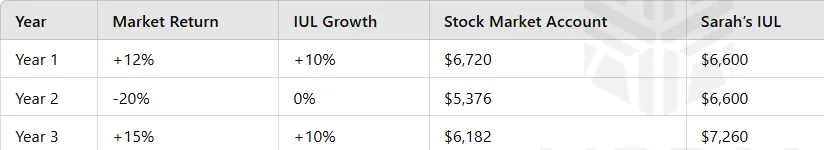

Here's an example that illustrates how an Indexed Universal Life (IUL) works in real-world terms. This will bring the concept to life and make it relatable.

Let’s Meet Sarah: Sarah is 45 years old and decides to put $500 a month into an Indexed Universal Life policy. She’s not a stock market expert, and frankly, she’s tired of worrying about the ups and downs of the market. She just wants her money to grow safely while planning for retirement and protecting her family.

Year 1: The Market Is Up

- The stock market gains 12% this year.

- Sarah’s IUL has a cap of 10% on growth.

- Her cash value earns the full 10%, adding a solid boost to her savings.

Sarah thinks: “I didn’t get the full 12%, but hey, 10% growth with zero risk? I’ll take it!”

Year 2: The Market Crashes

- The market drops by 20%. Investors everywhere are in a panic.

- But Sarah’s IUL has a floor of 0%, which means she doesn’t lose a penny. Her cash value stays exactly where it was at the end of Year 1.

Sarah thinks: “While everyone else is freaking out about their losses, I’m sitting here with my money safe and sound.”

Year 3: The Market Recovers

- The market rebounds and gains 15% this year.

- Sarah’s IUL credits her with the cap of 10%, locking in even more growth for her cash value.

Sarah thinks: “I didn’t get the full 15%, but I’m ahead because I never lost anything last year. Steady growth beats wild swings every time.”

Over Time: Here’s the beauty of Sarah’s IUL: while the market zigzags up and down, her money steadily grows because she avoids the losses altogether. Over 20 years, Sarah builds up a significant tax-free cash value, which she can use for retirement, emergencies, or even as a loan to herself.

Here’s the Side-by-Side Comparison

Let’s see how Sarah’s IUL stacks up against someone riding the stock market roller coaster with no protection:

YearMarket ReturnIUL GrowthStock Market AccountSarah’s IUL

The Result:

By Year 3, Sarah’s cash value is ahead of the stock market account, even though her IUL had a cap on growth. Why? Because she never lost money during the market downturn.

The Takeaway:

Sarah’s IUL works like a financial seatbelt, keeping her money safe while still letting it grow. And remember, this is just the cash value! On top of this, her family is protected with a tax-free death benefit if anything ever happens to her.

This is the magic of an IUL—growth without the risk, and peace of mind for your family.