How VitalShield Makes Medicare Simple for Those Turning 65 (And Solutions for Spouses Under 65)

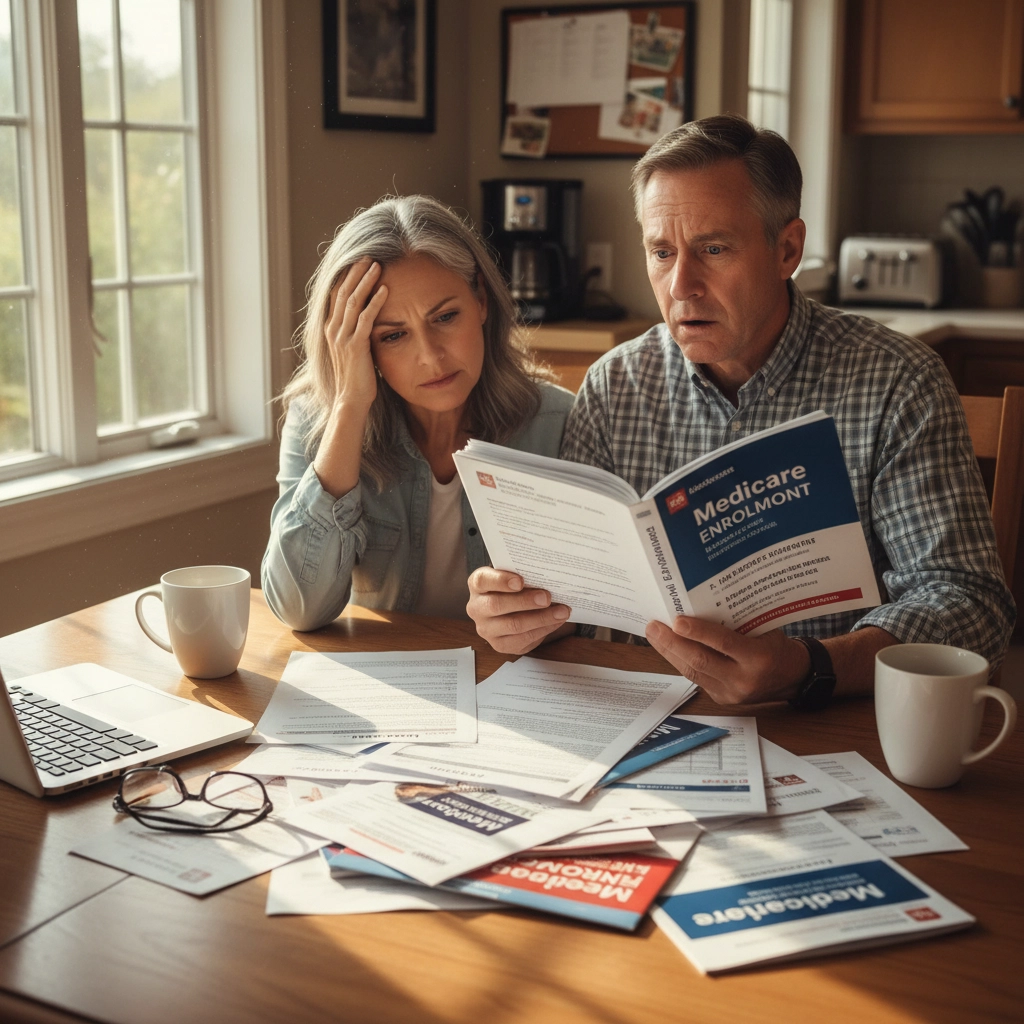

Turning 65 should feel like a celebration, not a homework assignment. But let's be honest, when that Medicare enrollment packet shows up in your mailbox, it can feel more overwhelming than exciting. And if you're married to someone younger than 65, the whole situation gets even trickier.

Here's the good news: at VitalShield, we've helped hundreds of families navigate this exact transition. We know the ins and outs, the deadlines that matter, and most importantly, how to make sure nobody in your family gets left without coverage.

Why Medicare at 65 Feels So Complicated

Most people think Medicare kicks in automatically when you hit 65, and sometimes it does. But there are so many "what ifs" and "depends on" scenarios that it's easy to miss something important.

Are you still working? Are you on your spouse's plan? Did you sign up for Social Security already? Each situation requires a different approach, and making the wrong choice can cost you big time in penalties that stick around for years.

That's where VitalShield comes in. Instead of trying to decode Medicare's 100+ pages of rules yourself, you get a real person (hello, that's me, Tim!) who speaks plain English and actually cares about getting this right for you.

How VitalShield Makes Medicare Enrollment Actually Easy

We Start With Your Real Life, Not Generic Rules

Every conversation begins with understanding your specific situation. Are you planning to keep working past 65? Do you have a spouse who still needs coverage? What medications do you take? Do you have preferred doctors you want to keep seeing?

These aren't just friendly questions, they're the foundation for building the right Medicare strategy for your family.

We Handle the Timeline Pressure

Medicare has some pretty strict enrollment windows, and missing them can cost you. Your Initial Enrollment Period starts three months before you turn 65 and ends three months after your birthday month. That might sound generous, but life happens fast.

At VitalShield, we put your important dates on our calendar too. We'll reach out before deadlines, walk you through what needs to happen when, and make sure nothing falls through the cracks.

We Explain the Parts That Actually Matter

Part A, Part B, Part C, Part D, Medigap, Medicare Advantage, it sounds like alphabet soup, but each piece serves a specific purpose in your healthcare coverage. Instead of overwhelming you with every detail, we focus on what applies to your situation and help you make informed decisions.

For most people turning 65, the big decisions are:

- Do you want Original Medicare (Parts A and B) plus a separate drug plan (Part D)?

- Or would a Medicare Advantage plan (Part C) that bundles everything together work better?

- Do you need a Medigap policy to help with out-of-pocket costs?

We break down the pros and cons based on your health needs, budget, and preferences, no insurance jargon required.

The Spouse Under 65 Challenge (And How We Solve It)

Here's where things get really tricky. You turn 65 and qualify for Medicare, but your spouse is, say, 62. What happens to their coverage?

This scenario is incredibly common, and it catches a lot of couples off guard. If you've both been on an employer plan or a marketplace plan, your spouse can't just join your Medicare, they're not eligible yet.

Option 1: COBRA Continuation

If you're leaving an employer plan, your spouse might be able to continue that coverage through COBRA. It's usually more expensive since you'll pay the full premium without employer contribution, but it can bridge the gap until they turn 65.

Option 2: Marketplace Coverage

Your spouse can shop for an individual health plan through the healthcare marketplace. Losing coverage because you became Medicare-eligible counts as a qualifying life event, so they won't have to wait for open enrollment.

Option 3: Short-Term Health Insurance

For healthy spouses who just need temporary coverage, short-term plans can be a cost-effective bridge. These plans have limitations, but they can work well for specific situations.

Option 4: Spouse's Own Employer Coverage

If your spouse works and has access to employer health insurance, this might be the perfect time for them to enroll in their own coverage.

At VitalShield, we don't just help you figure out Medicare, we make sure your whole family has a coverage plan that makes sense. We'll run the numbers on all these options and help you choose the path that gives your spouse the best coverage for the best price.

Why the VitalShield Approach Works

We're Local and We're Available

When you work with VitalShield, you're not calling a 1-800 number and getting transferred three times. You get direct access to our team, and we know the healthcare landscape in our area. We can tell you which local doctors accept which Medicare plans, which hospitals are in-network, and how the coverage actually works in real life.

We Think Long-Term

Medicare isn't a "set it and forget it" decision. Your needs will change, new plans become available each year, and your health situation might evolve. We stay in touch and review your coverage annually to make sure it's still the best fit.

We Handle the Paperwork Headaches

Enrollment forms, coordination between different insurance types, making sure effective dates line up correctly, we take care of the administrative stuff so you can focus on what matters.

Real Scenarios We Handle All the Time

The Working Couple: She's 65 and ready to retire, but he's 63 and plans to keep working for two more years. We help her transition to Medicare while keeping him on his employer plan, then coordinate his transition when he's ready.

The Early Retiree Situation: Both spouses retired at 62 and have been on marketplace coverage. When one turns 65, we navigate the Medicare transition and find the best marketplace option for the younger spouse.

The "Oops, I Missed Something" Fix: Someone thought Medicare enrollment was automatic, missed their window, and now faces penalties. We help minimize the damage and get them properly covered.

Making the Medicare Decision With Confidence

The bottom line is this: Medicare doesn't have to be scary, and your spouse doesn't have to go without coverage just because your ages don't line up perfectly.

At VitalShield, we've seen every combination of circumstances, and we know how to make this transition smooth for your whole family. We take the time to understand your situation, explain your options in plain English, and stick with you to make sure everything works the way it should.

Whether you're planning ahead or need help right now, we're here to make Medicare simple and ensure nobody in your family gets left behind when it comes to healthcare coverage.

Ready to make Medicare less overwhelming? Visit our Medicare page or give us a call. We'll walk through your specific situation and create a plan that works for your whole family: no stress, no confusion, just good coverage that makes sense.

Because turning 65 should feel like the beginning of something great, not the start of an insurance headache.